2025

January 3, 2025

Bargain-hunting after days of losses lifted equities to solid gains Friday despite rising bond yields. The Dow rose 0.8 percent, the S&P 500 advanced 1.3 percent and the Nasdaq rallied 1.8 percent. Oil prices rose and the dollar declined.

Megacaps and big technology shares, which have been beaten up since the year end holidays, led the winners to boost the major averages. Best sectors included energy, communications services, technology and consumer discretionary. Shares including Tesla, which is still down nearly 9 percent over the last five days, jumped by 8 percent Friday as traders saw it and other momentum trades as oversold.

The ISM manufacturing report, the main macro news event Friday, came in on the strong side of expectations, which lifted bond yields. Investors also noted the suggestion in the report that manufacturing is poised to recover further as 2025 unfolds, while the service sector remains robust.

Bargain-hunting after days of losses lifted equities to solid gains Friday despite rising bond yields. The Dow rose 0.8 percent, the S&P 500 advanced 1.3 percent and the Nasdaq rallied 1.8 percent. Oil prices rose and the dollar declined.

Megacaps and big technology shares, which have been beaten up since the year end holidays, led the winners to boost the major averages. Best sectors included energy, communications services, technology and consumer discretionary. Shares including Tesla, which is still down nearly 9 percent over the last five days, jumped by 8 percent Friday as traders saw it and other momentum trades as oversold.

The ISM manufacturing report, the main macro news event Friday, came in on the strong side of expectations, which lifted bond yields. Investors also noted the suggestion in the report that manufacturing is poised to recover further as 2025 unfolds, while the service sector remains robust.

Inflation no show

Inflation is determined not only quantity of money but also velocity of money.

Jobs Friday! (6/9)

US adds 130K jobs in August.

US avg hourly earnings rise 3.2%

Labor participation rate higher

Very hard to get a recession next 12 months! Give tje jobs report what does Fed do ? resteepen the yield curve

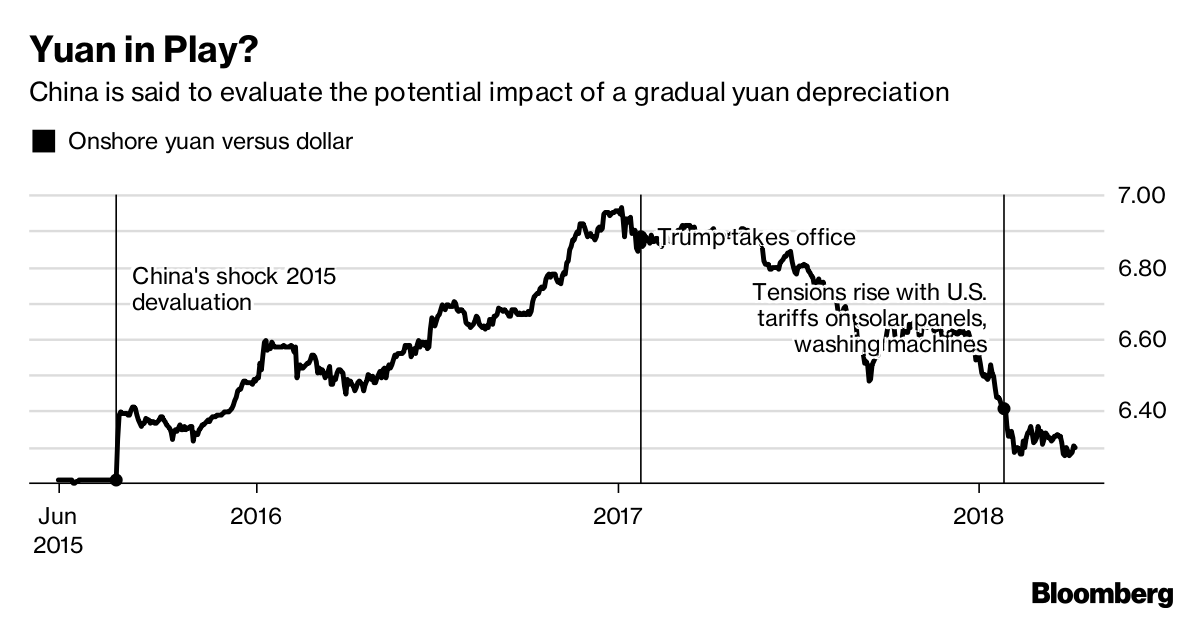

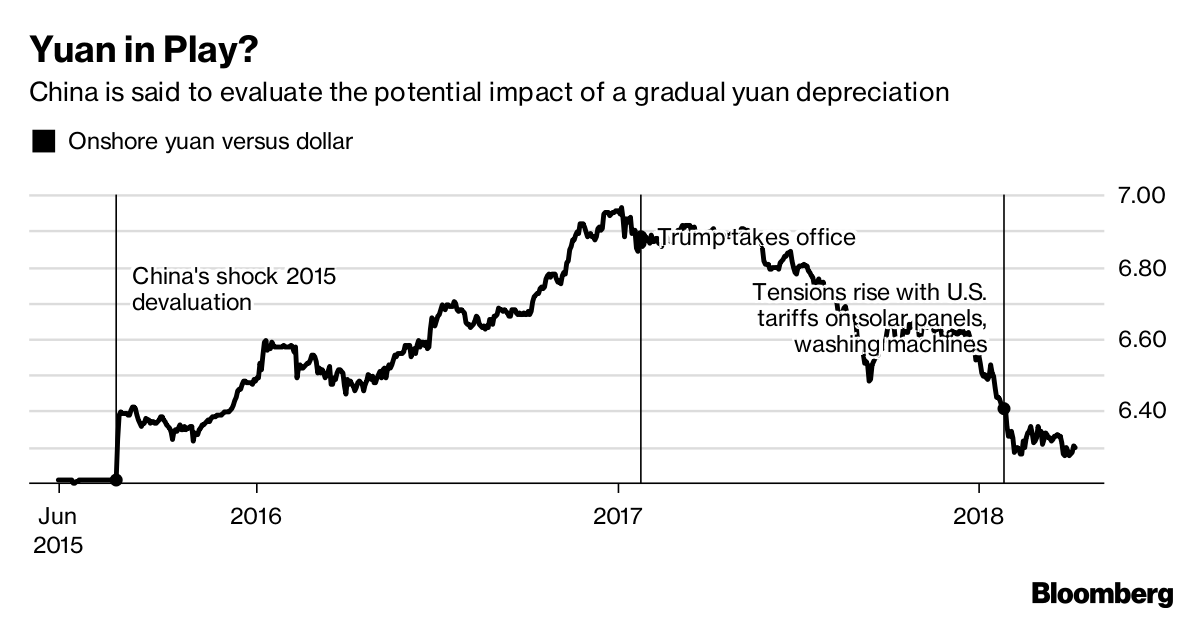

Trade Issue - Currency Play

The central scenario is that US Presidenta Donald Trump will seek an agreement with China to avoid an economic downturn in the run-up Nov. 2020 elections

In currencies, that means buying the Australian dollar and South Korean Won, which have been hit by the trade war and selling the Yen.

Trade Issue

Market is okay with the status quo, that's why they are rallying.

We get an ISM on Tuesday (Sep 3, 2019)

Investment compenent of GDP has turned negative YoY

Markets are bipolar!

Bond markets are priced for recession, yield low..Equity markets are high on the slightest good news on the trade front.

Marco Economics Issues

1. Get US budget deal done

2. US MCA deal

3. Brexit

4. China suitation

Futures Indicies

Overnight news markets overreact..

Fed Action

Howard Marks - Should Fed stimulate ? Is it the Fed's job to keep economy booming ? If the economy is generating enough jobs..I would leave it alone

Risk Measures to watch - Implied correlations are higher - a foward looking measure. S&P Skew three year high

The bond makert yield low - we are in a perpetual muddle through environment.

Central Banks (Aug 7, 2019)

NZ, Thailand, India cut rates to weaken their currency. However, central banks may lose ammunition if the economy weakens further.

Tariffs

We have seen less impact of China tariffs because of China currency devaluation. Coupled with strong dollar, tariffs have had less of an impact

Fed Action Update - Gave three reasons for rate cut today (7/31), first in 12 years (last time was in Dec 2008)!

1. Global Growth Concerns - China PMI index declining, Europe

2. Business Investment Slowed Down

3. Inflation Remains Muted ( Biggest reason for rate cut) - Strong Dollar, Excess Oil Reserves

Fed signalled this as mid-cycle rate cut. The most interesting reaction was dollar went up, instead of going down when rates are cut.

Fed Action

Fed is cutting (July 31st) to signal a pause.. pause on the hiking of rates.

The market is not all knowing!

Equity Markets are forward looking and bond markets backward looking ?

Fed backstops, good for risk assets

Fed want to steepen the yield curve... the deflationary forces.. there's one price thats the low price on Amazon!

Capex is suffering, so there's a case for 50 bps

Consumer Spending Driving the Bull Market

1. Retail sales, excluding autos, gas, and building materials, grew at an inflation-adjusted 6.1% annualized rate last quarter, according to Tom Porcelli, RBC Capital Markets’ chief U.S. economist—the fastest pace in over a decade and a half

2. Among companies reporting during the first week of earnings season, consumer-focused businesses outpaced their more industrial or manufacturing-sensitive peers, noted Edward Yardeni, president of Yardeni Research. . “This week saw bank earnings bolstered by consumer lending, retail sales up strongly, and airline earnings kept aloft by travelers willing to spend.”

3. “The consumer in the United States is doing fine,” said JPMorgan Chief Executive Jamie Dimon on the company’s earnings call Tuesday. “Business sentiment is a little bit worse, mostly probably driven by the trade war.”

4. The contrast between the economy’s consumer and industrial segments is stark. RBC’s Porcelli predicts 4% growth for overall consumer spending in the second quarter.

TSLA Investment Thesis - ARK Investments

While its stock dropped this week after Tesla reported lower gross margins in its second quarter (2019) report, regulatory credits obfuscated some progress.

Excluding regulatory credits, Tesla’s automotive gross margin increased roughly 200 basis points to 17.2% despite a drop in average selling prices (ASPs).

While still below 20%, Tesla’s gross margin should continue to increase as its production scales and battery costs continue to fall. Moreover, once Tesla releases full self-driving capability, we believe its margins should expand even faster as its revenue base shifts towards software-based, recurring revenue products and services.

Cheap vs. Expensive

Cheap stocks are supposed to outperform expensive stocks over long periods because investors underestimate the potential for change -- for struggling companies to right themselves, or thriving companies to exhaust growth opportunities.

In the recent past (2018), value has lagged growth. So far ,Growth continues to dominate this year (2019)

"When people agonize on value versus growth, really all they're doing is making a bet on technology," saysJim Paulsen , chief investment strategist at the Leuthold Group. He points to the close correlation of growth's outperformance since the 1990s with that of the tech sector.

Indexes Facts

Correlations

S&P Healthcare

10 Reasons Volatility Is Healthy

Price volatility is an important feature of a properly functioning capital market for risk assets. Here's why volatility is healthy

Fed Drift

Inflation is determined not only quantity of money but also velocity of money.

Jobs Friday! (6/9)

US adds 130K jobs in August.

US avg hourly earnings rise 3.2%

Labor participation rate higher

Very hard to get a recession next 12 months! Give tje jobs report what does Fed do ? resteepen the yield curve

Trade Issue - Currency Play

The central scenario is that US Presidenta Donald Trump will seek an agreement with China to avoid an economic downturn in the run-up Nov. 2020 elections

In currencies, that means buying the Australian dollar and South Korean Won, which have been hit by the trade war and selling the Yen.

Trade Issue

Market is okay with the status quo, that's why they are rallying.

We get an ISM on Tuesday (Sep 3, 2019)

Investment compenent of GDP has turned negative YoY

Markets are bipolar!

Bond markets are priced for recession, yield low..Equity markets are high on the slightest good news on the trade front.

Marco Economics Issues

1. Get US budget deal done

2. US MCA deal

3. Brexit

4. China suitation

Futures Indicies

Overnight news markets overreact..

Fed Action

Howard Marks - Should Fed stimulate ? Is it the Fed's job to keep economy booming ? If the economy is generating enough jobs..I would leave it alone

Risk Measures to watch - Implied correlations are higher - a foward looking measure. S&P Skew three year high

The bond makert yield low - we are in a perpetual muddle through environment.

Central Banks (Aug 7, 2019)

NZ, Thailand, India cut rates to weaken their currency. However, central banks may lose ammunition if the economy weakens further.

Tariffs

We have seen less impact of China tariffs because of China currency devaluation. Coupled with strong dollar, tariffs have had less of an impact

Fed Action Update - Gave three reasons for rate cut today (7/31), first in 12 years (last time was in Dec 2008)!

1. Global Growth Concerns - China PMI index declining, Europe

2. Business Investment Slowed Down

3. Inflation Remains Muted ( Biggest reason for rate cut) - Strong Dollar, Excess Oil Reserves

Fed signalled this as mid-cycle rate cut. The most interesting reaction was dollar went up, instead of going down when rates are cut.

Bull Steepener vs. Bear Steepner

Bull Steepener - When short term interest rates fall faster than long term interest rates. This often happens when the Fed is expected to lower interest rates, a bullish sign for both the economy and stocks

Bear Steepner - When long term interest rates rise faster than short term interest rates. This often happens when inflation expectations pick up, at which point the market may anticipate a fed rate increase to battle upcoming inflation. This scenario would be be bearish for both the economy and stock market.

Fed is cutting (July 31st) to signal a pause.. pause on the hiking of rates.

The market is not all knowing!

Equity Markets are forward looking and bond markets backward looking ?

Fed backstops, good for risk assets

Fed want to steepen the yield curve... the deflationary forces.. there's one price thats the low price on Amazon!

Capex is suffering, so there's a case for 50 bps

Consumer Spending Driving the Bull Market

1. Retail sales, excluding autos, gas, and building materials, grew at an inflation-adjusted 6.1% annualized rate last quarter, according to Tom Porcelli, RBC Capital Markets’ chief U.S. economist—the fastest pace in over a decade and a half

2. Among companies reporting during the first week of earnings season, consumer-focused businesses outpaced their more industrial or manufacturing-sensitive peers, noted Edward Yardeni, president of Yardeni Research. . “This week saw bank earnings bolstered by consumer lending, retail sales up strongly, and airline earnings kept aloft by travelers willing to spend.”

3. “The consumer in the United States is doing fine,” said JPMorgan Chief Executive Jamie Dimon on the company’s earnings call Tuesday. “Business sentiment is a little bit worse, mostly probably driven by the trade war.”

4. The contrast between the economy’s consumer and industrial segments is stark. RBC’s Porcelli predicts 4% growth for overall consumer spending in the second quarter.

TSLA Investment Thesis - ARK Investments

While its stock dropped this week after Tesla reported lower gross margins in its second quarter (2019) report, regulatory credits obfuscated some progress.

Excluding regulatory credits, Tesla’s automotive gross margin increased roughly 200 basis points to 17.2% despite a drop in average selling prices (ASPs).

While still below 20%, Tesla’s gross margin should continue to increase as its production scales and battery costs continue to fall. Moreover, once Tesla releases full self-driving capability, we believe its margins should expand even faster as its revenue base shifts towards software-based, recurring revenue products and services.

Cheap vs. Expensive

Cheap stocks are supposed to outperform expensive stocks over long periods because investors underestimate the potential for change -- for struggling companies to right themselves, or thriving companies to exhaust growth opportunities.

In the recent past (2018), value has lagged growth. So far ,Growth continues to dominate this year (2019)

"When people agonize on value versus growth, really all they're doing is making a bet on technology," says

Indexes Facts

- S&P have outsized exposure to 5 global Tech names which have a collective weight higher than all but 2 entire sectors.

- Russell single stock exposure is low but you have a large dose of Financials and Industrials relative to the S&P.

- EM equities are a play on China’s economy/equity market with a strong additional dose of greater Asia exporters.

- EM bonds as an asset class have exposure to a raft of developing economies, each with their own disparate fundamentals.

- Investment grade bonds (LQD ETF) have outsized exposure to the health of the financial industry (more than Tech does in the S&P, for example).

- Junk bonds (HYG EFT) have a similar weight to the sustainability of cash flows in the Telecomm sector (and, again, more than Tech’s weight in the S&P).

Correlations

- Correlations are fascinating because they are considered as signposts on the journey through a capital markets cycle.

- Post-Crisis recovery (2010 to 2013, peak correlations): Correlations .9 to 1 as high as they go. Investors were treating equities as an asset class rather than a collection of individual stocks with varying fundamentals.

- Normalization (2014 and 2015, falling correlations): correlations declined to annual averages of 0.75 to 0.82. Markets were sensing the worst had passed, and began to differentiate between various sectors.

- Trough correlation (2017, the low point of this cycle):

- Current conditions (2018 year to date, end-of-cycle fears):

- Correlation tends to be “sticky” absent an overwhelming catalyst

- High sector correlations are not necessarily negative for US stock returns.

- Financials are approx 13.1% of the S&P 500.

- Financials stabilizing soon, should indicate a cyclical low in market sentiment.

- 14.7% of the index sits in just 5 names: Microsoft, Apple, Amazon, Facebook, and Alphabet/Google.

- If those 5 names were a “sector”, they would be larger than all but 2 industry groups as currently classified.

- As an ensemble these stocks are, for example, larger than the collective weight of every bank, brokerage, insurance company and asset manager in the index (a.k.a. the Financials, the third largest sector in the S&P 500).

- The same 5 Tech names are also larger than the combined weight of the smallest 4 sectors: Energy (5.5%), Utilities (3.3%), Real Estate (3.0%) and Materials (2.6%). The combined total of these is 14.4%.

- If you add the S&P 500 weightings of Amazon (3.0%), Facebook (1.6%), Google (2.9%), and Netflix (0.5%) to the S&P Technology sector (none are actually in that group) you get a total weighting of 28.2%.

S&P Healthcare

- 15.6% of the index sits in just 5 names: Microsoft, Apple, Amazon, Facebook, and Alphabet/Google.

- The S&P Health Care sector has not changed in the way others (Technology, Consumer Discretionary, Communications) have over the years.

- Long-term macro factors like the ebbs and flows of regulation and an aging US population have not fundamentally changed the weighting of Health Care in the S&P over the last 18 years

- Of all the major stock markets of the world, only the US has created real value for shareholders since the Financial Crisis.

- The MSCI Emerging Markets Index is currently right where it was in April 2007. That’s a lost decade, and then some…

- The MSCI Developed Economy EAFE (Europe, Asia, Far East) sits at the same level as January 2006. And that’s with central bank intervention that makes the Fed look miserly by comparison.

- The S&P 500 is +73% higher than its 2007 highs.

10 Reasons Volatility Is Healthy

Price volatility is an important feature of a properly functioning capital market for risk assets. Here's why volatility is healthy

- It reminds investors that there is still no such thing as a free lunch

- It makes corporate managements more aware of market signals regarding their performance.

- It gives humans a better shot against algorithmic approaches to investing.

- It shakes out the weak.

- Volatility keeps monetary policymakers and elected officials on their toes.

- It can curtail excesses before they reach dangerous levels

- Volatility will stress test new robo-advisor business models, none of which have seen a significant market correction since hitting critical mass.

- It forces more rational valuations and exit strategy planning at venture capital firms.

- Volatility takes the safety net away from “passive” investments.

- Volatility enables capitalism to function properly, supporting democratic institutions.

Fed Drift

- In the past few decades stocks in the U.S. and several other major economies have experienced large excess returns in anticipation of U.S. monetary policy decisions made at scheduled policy meetings.

- The NY Fed’s 2018 update, published in late November showed that the “Fed drift” stock market anomaly now only applies to Fed meetings with an accompanying Chair press conference and releases of a new Summary of Economic Projections (SEP).

- “People underweight outcomes that are merely probable in comparison with outcomes that are obtained with certainty.” (From the original Kahneman & Tversky paper).

- Humans “feel” a loss more acutely than a gain of a similar amount. Losing $100 on a poker hand generates more unhappiness than winning $100 makes us happy.

- We also tend to overweight the importance of low probability events (which is why lotteries are so popular, for example, or why we fear market crashes).

- This has relevance from a markets perspective because:

- #1 When markets are down, fear of losses to come are swamping investor confidence in the possibility of future gains. Prospect Theory explains why: losses “hurt” more than equivalent gains.

- #2 While there may be technical reasons for the recent volatility, ranging from hedge fund redemptions to year-end portfolio reallocations out of stocks, those don’t matter to investor psychology just now. There are no asterisks in Prospect Theory – it always works the same way.

- #3

- Sector Concentration - Financials have the largest weighting in the Russell 2000, at an 18.0% allocation. The top names here (Berkshire, JP Morgan, B of A, Wells and Citi) share little in common with the largest firms in the Russell (Iberia, MGIC, Radian, FirstCash, and MB Financial).

- Underlying corporate profitability/access to capital - where S&P 500 companies are collectively famous for their penchant to repurchase their own stock with excess capital, over a third of Russell 2000 is in a chronic capital deficit position. And when market volatility threatens to close/curtail access to capital markets, small caps will underperform.

- Stock concentration -

- The top 5 names by weighting in the Russell 2000 represent just 1.5% of the index.

- By contrast, the top 5 names in the S&P 500 are 14.7% of the index.

- The top 5 names by weighting in the Russell 2000 represent just 1.5% of the index.

20 Year Trailing Return of US Stocks